The Tax Cuts and Jobs Act of 2017 (P.L. 115-97) allowed governors to nominate certain census tracts as Opportunity Zones, subject to approval from the U.S. Department of the Treasury. Up to 25% of a state’s low-income census tracts were eligible for designation.

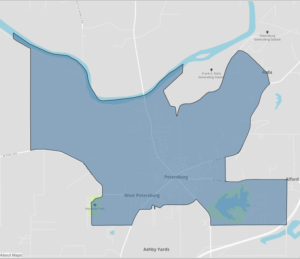

156 Opportunity Zones in Indiana were selected based on a combination of factors including existing economic development programs and local coordination, economic and community data, likelihood of attracting short- and long-term investment, and growing industry sectors within the community. Rest assured that we’ve put in the time and effort so that you have access to the areas that are ready for investment.

In October 2018, the U.S. Department of the Treasury released initial guidance for investors interested in Opportunity Zones. The guidance provides clarity on several items related to Opportunity Zones including who is eligible to participate, the timing of transactions necessary for satisfying the requirements of the statute, certain rules related to the creation of an Opportunity Fund, and how to ensure the fund remains qualified for the tax incentives provided through the program. The full regulations can be found at www.irs.gov/pub/irs-drop/reg-115420-18.pdf.

Looking for more information about Opportunity Zones? The U.S. Department of the Treasury and the Economic Innovation Group have provided more information here and here. The text of the legislation creating the Opportunity Zone program can be accessed here.